“He who controls the money supply of a nation controls the nation.”

– James A Garfield, 20th president of the United States

Answer to a broken system?

In 2008, we saw the worst financial crisis in recent history. Also known as the Great Recession, the 2008 financial crisis resulted in the loss of over seven million jobs, leaving thousands homeless. Occupy Wall Street placed the blame solely on the big banks. They accused big banks of misusing borrowers’ money, duping clients, rigging the system, and charging extortionate fees.

In response to the banks misuse of power and responsibility, a developer going by the name of Satoshi Nakamoto decided to create an alternative financial system. This system would put the seller in control, eliminate middlemen, cancel interest fees, and make transactions transparent to prevent corruption. The currency at the centre of this new system was named Bitcoin.

Bitcoin is a divisive and controversial subject. Over the years many experts have boldly predicted its demise – so far, they have all been wrong. Bitcoin continues to flourish and gain recognition as a hedge against the financial system and an important lifeline for those who have been failed by central banks.

Getting to grips with Bitcoin can be complicated and confusing. That’s why we’ve created this guide – to provide you with a clear, concise understanding of everything you need to know about this revolutionary technology.

What is Bitcoin?

Bitcoin was the first cryptocurrency, a form of electronic cash created by a developer going by the name of Satoshi Nakamoto but whose actual identity remains unknown. Unlike pounds or dollars, bitcoins aren’t printed, they’re produced by computers around the world through a process known as mining.

There will only ever be 21 million bitcoins in circulation. Currently there are around 17 million bitcoins in circulation, with the remainder of bitcoins to be released into circulation through the mining process (skip to ‘Important Bitcoin Terms’ to understand more about mining). A computer algorithm controls how many coins are released into circulation; it is estimated that it’ll be year 2140 before all 21 million bitcoins have been mined.

Bitcoin is the first money in the world that is governed entirely by the laws of mathematics and not the legal-regulatory apparatus of a select group of powerful, wealthy individuals.

Anyone who is willing to invest in the appropriate software & hardware can mine bitcoin. This means that no one owns Bitcoin. Unlike a central bank, which owns and controls how money is distributed and printed, Bitcoin has no CEO. Having no central point of authority enables Bitcoin users to send funds directly to each other, eliminating the need for a bank or middleman.

Important bitcoin terms

First of all, it would be wise to explain a few important bitcoin terms. The bitcoin world is full of jargon that can appear confusing. Here are some commonly used terms you’ll need to know.

– Blockchain

All Bitcoin transactions are recorded permanently on a blockchain. A blockchain is a public record used to verify bitcoin transactions. Transactions are recorded on blocks; a new block is added to the chain roughly every 10 minutes. You can learn more by watching this video.

– Bits and Satoshis

Bits (formally known as microbitcoins) and Satoshis are sub-units of Bitcoin, similar to pennies and cents. One Bit equals ₿0.000001, one Satoshi equals ₿0.00000001 (one hundred millionth of a bitcoin).

– BTC or XBT

Bitcoin is often abbreviated as BTC or XBT

– Confirmation

Confirmation is when a transaction has been processed by the network and has been recorded onto a block. Multiple confirmations occur as transactions are recorded onto subsequent blocks, and each transaction decreases the risk of a reversed transaction.

– Mining

Mining is a metaphor for Bitcoin’s proof of work system. This is where miners use soft and hardware to solve complicated math problems that validate every bitcoin transaction in exchange for bitcoins. These complex mathematical calculations are necessary to increase security and subsequently release newly created bitcoins.

The mining process was designed to mimic physical mining such as that for gold or precious jewels. The difference with bitcoin mining is that it’s done using mining hardware and software. Mining is probably the hardest but most profitable way to earn bitcoin.

The block reward for solving these math problems is currently 12.5 tokens — the equivalent of around £80k today. There are currently around 17 million bitcoins in existence, with a cap of 21 million. That leaves roughly 4 million more bitcoins to mine. Find out more here.

– Private Key

A private key is a confidential piece of data that verifies your right to spend bitcoins from a specific wallet. It’s like a Bitcoin password or a credit card pin code. Each wallet is associated with its own private key. Never give away your private key!

– Signature

A signature is a piece of cryptography that verifies your bitcoin ownership — it’s the public-facing side of your private key. But don’t worry, cryptography ensures that no one can guess or decipher your private key or other data.

– Halving

As we’ve already established, one of the most important characteristics of Bitcoin is that there’s a cap on the number of bitcoins that will ever be in circulation. The creation of new bitcoins is predictable and transparent to everyone. This is different from the traditional banking sector, where central banks can keep printing more money, almost without limitations which in turn weakens the spending power of your money.

The bitcoin block halving is the moment that the miner reward per block is divided by two. This halving takes place every 210,000 blocks. Mining one block takes ten minutes on average, so it can be estimated that there is a bitcoin block halving approximately every four years. This continues until 21 million bitcoins are circulating.

The next halving should occur at some point in early May 2020. Many traders believe that the halving affects the price of bitcoin directly. The first halving took place in 2012. A year later, bitcoin reached an all-time high price. The same thing happened a year after the next halving, in 2017.

Currently there are 1,700 bitcoins mined every day. The vast majority of those coins are sold instantly to cover mining expenses. When there is a halving, the number of coins being injected into the market will decrease, leading to more scarcity. This is the best logical explanation behind the dramatic price increases that occur after halvings.

How is bitcoin different to traditional fiat currencies?

Although Bitcoin can be used to pay for things electronically much like dollars or pounds, it differs from fiat currencies in several important ways.

1. Decentralization

Bitcoin’s most important characteristic is that it is decentralized. No single entity can control bitcoin as the system is maintained by coders and run by an open network of dedicated computers which mine bitcoin. These dedicated computers are situated all around the world. The main appeal of this is it eliminates the high degree of control that the current central banking system has over our money.

2. Limited supply

Fiat currencies (dollars, euros, pounds, etc.) have an unlimited supply – central banks can print as much as they like and can even manipulate a currencies value. Current well-known examples include countries such as Venezuela or Zimbabwe where hyperinflation is so bad that their currency has very little value.

With bitcoin, supply is tightly controlled by the underlying algorithm. A small number of new bitcoins trickle out every hour, this will continue to happen at a diminishing rate until a maximum of 21 million bitcoins have been produced. This deflationary property is what makes bitcoin attractive as an asset. If demand for bitcoin increases but the supply remains the same – this should cause the value of bitcoin to increase.

3. Pseudonymity

Traditional electronic payment methods usually require sender identification for verification and legislation purposes. However, bitcoin operates in semi-anonymity. Since there is no central validator with bitcoin this enables bitcoin users to skip the verification processes associated with central banks.

However, the address of each bitcoin wallet can be used to identify users. This enables law enforcers to identify bitcoin users if necessary. Since the network is transparent, the progress of a particular transaction is visible to all. This means that, quite contrary to what we read in the media – bitcoin is not an ideal currency for money launderers, terrorists and criminals.

4. Immutability

Bitcoin transactions cannot be reversed, unlike electronic fiat transactions.

This is because there is no central “adjudicator” who confirms a transaction reversal. After a transaction has been fully completed it is impossible to modify.

Whilst this can sound disconcerting, it actually means that the network cannot be tampered making it extremely difficult to confiscate funds from their owners.

5. Divisibility

The smallest unit of a bitcoin is called a satoshi. It is one hundred millionth of a bitcoin (0.00000001). Having such a small fraction can enable microtransactions that other electronic payments or physical money can’t. For example, with GBP, the smallest amount you can have is 1p and there is no way to divide this further.

6. Easier to authenticate

Cash is notoriously easy to counterfeit. It is predicted that 1 in 20 pounds in the UK are fakes. However, many experts put this figure at much higher due to the fact that many counterfeit notes go unnoticed. Bitcoin is an online currency. All bitcoin transactions are recorded on an immutable online ledger providing greater transparency, making counterfeiting almost impossible.

How to buy bitcoin

These days, buying bitcoin is easy. The best place to buy bitcoin in the UK is through a well-known vendor such as Paxful, Binance or Coinbase.

Simply sign up, verify your identity and add a payment method. You can also exchange money for bitcoin in person at a Bitcoin ATM, retail store, or directly with another person.

How to store bitcoin

Many bitcoin users simply purchase their bitcoin and leave it on the exchange. This is generally fine for smaller amounts. However, be warned that if your account is compromised, you may lose your bitcoin with no way of retrieving your stolen coins.

Hacking is also another issue within the cryptocurrency industry, with several high-profile hacks occurring over the years. Luckily, nowadays the majority of trusted exchanges are insured to cover such losses. If you’re not willing to leave your bitcoin on an exchange, the safest place to store bitcoin is in a wallet. There are 3 types of wallet: Software, Hardware & Paper.

– Software wallet (least secure, most convenient)

Software wallets include desktop, online, and mobile wallets. Software wallets are great for quick access and easy transfers, however they are also more susceptible to cybercrime. Also, depending on the type of wallet, it could be compromised if you break your device. Examples of software wallets include Coinbase wallet or Bitgo.

– Hardware Bitcoin Wallets (most secure)

Hardware bitcoin wallets live on an external device like a hard drive or USB. They’re accessible by plugging that device into a computer and logging in. These wallets are considered cold storage since data is stored completely offline.

Cold storage provides the best security and is best for large sums of bitcoin. However, they do take a bit more time to set up and aren’t ideal to use in a rush. Arguably the best hardware wallet is ledger.

– Paper Bitcoin Wallets

A paper bitcoin wallet is a piece of paper containing your private keys. All you have to do is safely store the paper somewhere. These wallets are another type of cold storage and easy to generate using sites such as WalletGenerator.net. Just make sure you don’t lose the paper!

How to spend bitcoin

When you set up your bitcoin wallet, you’ll be creating a public bitcoin address which will look something like this: 2GV5Hie4LCfpkHiV5oHiQsZk8kq2HixvCK.

This address acts the same as a physical or email address in that in contains all the information needed for someone to send you bitcoin. In order to receive bitcoin simply share your address. Be sure only to share your public address and not your private key. Sharing a private key will enable someone to access your funds.

To send bitcoin simply enter the recipient’s bitcoin address and send the desired funds. Be sure to double check the address matches the intended destination.

Risks of using Bitcoin

Being a largely unregulated market, cryptocurrency is notorious for scams and price volatility. However, most of these risks can be eliminated by doing the following…

- Store only small amounts of bitcoin on software wallets and keep larger amounts in offline or paper wallets.

- Back up your wallet on a regular basis and keep your private keys and other data secure and offline.

- Only buy your bitcoin from a trusted exchange such as Paxful or Coinbase.

Scams

As bitcoins popularity grows, scams are becoming more and more sophisticated. Most of these scams can be avoided with a bit of common sense and following the advice above. However, here are a few well known scams you should be aware of:

– Wallet scams

Fake online wallets will ask for your money upfront or give you a bitcoin address that leads to the scammer, not you. Fake hardware wallets will have built-in vulnerabilities that make it easy for scammers to steal your bitcoins when digitally activated. Never buy a second-hand hardware wallet.

– Mining scams

Because bitcoin mining requires considerable time and resources, fake mining companies will offer to mine on your behalf if you pay them. Others will offer to “rent” server space on which to mine bitcoin. While some of these are legitimate, many are scams or Ponzi schemes. We recommend avoiding them all.

– Exchange scams

There are many unregulated cryptocurrency exchanges which are susceptible to scammers and hackers. Furthermore, scam exchanges often offer unrealistic exchange prices and operate on unsecured websites.

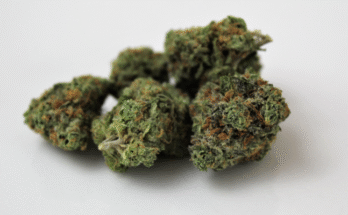

Bitcoin and weed

Bitcoin has transformed the way we buy weed. Bitcoin and weed go all the way back to silk road in 2011. Today, online marketplaces (mostly on the dark web but not all) are booming in popularity with bitcoin being the preferred currency of choice.

Thanks to bitcoin, stoners all over the world now have access to a variety of different products, vendors and strains.

If you want to find out how you can use bitcoin to buy your weed, take a look at our guide here.

The future of bitcoin

Like any new, experimental technology, the future of bitcoin is always uncertain. Over the years several high-profile academics and investors have slammed bitcoin as a failed currency due to its volatility. Others have called it a speculative bubble that will eventually crash to zero. However, if you look beyond this criticism there is plenty to be optimistic about.

So far bitcoin has stood the test of time. Bitcoin was created in the wake of the 2008 financial crisis. It was designed to be resilient and that it has been. On 3 occasions the price of bitcoin has crashed spectacularly and, in some cases, has lost almost 95% of its value. Each time this has happened though, Bitcoin has been come back stronger than ever.

The majority of bitcoin criticism comes from individuals who are heavily invested in the traditional financial system. Bitcoin believers tend to be millennials, and this is evident when we look at investing behaviour amongst this age group. Reports show that millennial investors are more likely to own bitcoin derived stocks than popular stocks such as Uber or Netflix.

Furthermore, millennials are 5x more likely to own Bitcoin in comparison to boomers. This rise in popularity has also influenced big names in finance such as the New York Stock Exchange and Fidelity Investments to increase their investments and involvement in cryptocurrency.

Many believe that Bitcoin’s main strength comes as a store of value rather than as a currency. Bitcoin’s claim as a store of value is becoming increasingly evident as time goes by. This effect is most noticeable in countries suffering from hyperinflation or going through a financial crisis.

A textbook example of this is Venezuela. High levels of corruption and manipulation have resulted in their currency losing most of its value. This loss in value means Venezuelans have little faith in their financial system, and instead of keeping money in a bank account they look for an alternative store of value.

One popular alternative is gold, the only issue with gold is that it’s difficult to authenticate, difficult to store and difficult to transport due to its weight. Bitcoin overcomes all these issues and provides many advantages when compared to gold or fiat currency.

For years now, many economists have been warning us about the perils of a fractional reserve banking system. Printing money out of thin air can’t last forever and eventually the financial system that we all know could collapse.

It can be argued that bitcoin’s qualities make it an improvement on the current system and it’s therefore the perfect hedge against a monopolised, debt-ridden central banking system.

Our current financial system can seem slow and clunky, especially in a world where an increasing amount of business is conducted online. The rise of the internet has also created a greater need for frictionless, near instant, cross-border payments.

Currently, sending money across borders can often take up to a week, usually incurring expensive fees. Bitcoin allows value to flow seamlessly across borders at a fraction of the cost with no permission needed.

Therefore, much like the internet in the early 90s, as Bitcoin’s usability improves so could its adoption as a universal online currency.

Featured image: https://imgur.com/R53xGa8

Great content, thanks for the article, now i know how to buy bitcoins online in the uk

When you buying BTC on Coinbase you need to calculate transaction fees on the top of weed price that’s why is more sensible to use Coinbase Pro where max fees are about 0.5%. also I would like to recommend Monero instead of BTC in terms of bulk buying. BTC is traceable. It’ll take some time but you can go through transaction straight to the buyer and if someone want to identify your personality easy can do this. With Monero it’s impossible that’s why Monero is called “cartel currency”.

I read somewhere that Coinbase keep track of where you spend your bitcoin, and if it is for anything illegal they will bar you. (not sure what this involves or whether you lose money). Have you heard anything similar or was this just someone trolling? I have been trying to avoid having to buy BTC but it seems the only way to buy online. I am more boomer than millenial so I am not great with this stuff :/

Hi Rita. Thanks for reaching out. I have also heard that Coinbase can close your account if they suspect you’re using Bitcoin for illicit purposes. However, I think it applies more to larger payment. Payments under £100 or so should not be flagged. Ive made quite a few at this point and haven’t had any trouble. Good luck!

You’ve got two types of transactions – On-chain and Off-chain.

On-chain transaction is sending cryptocurrency to another account outside of Coinbase’s – anyone who views the respective blockchain explorer can follow where that cryptocurrency went. Easy.

Off chain transaction it’s basically sending crypto from your Coinbase account to Coinbase wallet – tracks aren’t publicly available, but Coinbase has an internal data store for keeping track of these and if someone wants access need some kind of authorisation.

So – if you going to spend few thousands of pounds for weed beter “wash” your money through a tumbler. If you going to spend £100 or something – trust me, no one don’t give a shit about it. Remember one simple thing – your crypto wallet is linked to your IP.

Hi m8

If the wallet is tied to your IP Address then for the majority of Internet users this is a fail as most people are dynamically assigned a IP Address each time they log on & even more so if using a VPN (which I would say was mandatory anyway and is recommended by a lot of exchanges and wallet providers) therefore are you in fact saying you need a fixed IP Address ? Or are you inferring that the individual transactions are tied to the IP Address you are using at that time with the IP Address changing for the next time you log on to do another transaction ?