You may have heard that New York just became the latest US state to approve recreational cannabis legalisation.

While that is great n’all – especially the provision that expunges certain cannabis convictions – the state’s plans for the industry are not all so intelligent.

As well as charging a 13% sales tax on top of general state and local sales taxes (which can be as much as 8.9 % combined), there will also be a tax on THC levels that can range from 5-30%.

New York’s high cannabis taxes (much higher than many other legal states) will give the state’s sophisticated black market the opportunity to flourish by providing products much cheaper than state-approved vendors will be able to.

Thus the state cashes in on affluent consumers while the war on (black market) drugs continues in the background.

Legalisation

New York Gov. Andrew Cuomo last week signed a bill that allows recreational use of cannabis for adults over the age of 21.

Although retail sales aren’t expected to commence until 1-2 years time, a number of big players in the cannabis industry are already eyeing up what could become a $5 billion to $7 billion industry – one of the biggest in the US.

New Rules

While New York’s new cannabis law does include high taxes and other questionable provisions, it does have some very good aspects to it.

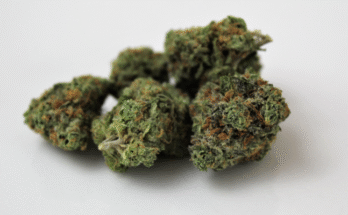

Residents 21 or older will be allowed to possess up to three ounces of flower and up to 24 grams of concentrates in public, as well as up to five pounds of flower at home. They are allowed to give those amounts to other adults, but can’t charge for it.

It will also be legal to consume cannabis anywhere that tobacco smoking is allowed, as well as in specially licensed “consumption sites,” which can operate in conjunction with dispensaries.

Not only that, One of the most positive aspects of New York’s law is a provision that will “vacate, dismiss and expunge” the convictions of people serving sentences for cannabis-related conduct that is no longer considered a crime.

Grow your own

When it comes to rules for growing your own cannabis, New Yorkers will be permitted to grow up to six plants, with only half of them mature at any given time, with a limit of 12 plants per household.

However, this won’t be allowed until up to 18 months after the first recreational retailer opens, which may not happen until late next 2022.

Taxes

While these stipulations all sound promising, the taxes that will be applied to cannabis in New York are a cause for concern. Not least the excise tax based on THC content.

For cannabis flowers, the rate per milligram of THC will be half a cent. For concentrates it will be eight-tenths of a cent, while edibles will be 3 cents per mg.

Based on a standard 10-milligram dose, the tax will be 5 cents for flower, 8 cents for concentrates, and 30 cents for edibles.

On top of THC tax, New York will impose a 9% tax on retail sales of cannabis products, plus a 4% tax that will go local governments. And then there’s general state and local sales taxes, which can reach up to 9%.

All this means that retailers will be forced to overcharge consumers for products – products that can be obtained cheaper via the black market.

So, while the move is a good start and prices should drop over time, New York’s legalisation of recreational cannabis is another example of consumer extortion masquerading as cannabis liberation.